I will start our tutorial by justifying why I think the FinTech market is under its best light. FinTech is one of the highest growing technology segments, bringing innovation to almost every segment, including stock trading, credit scoring and even your loan payments. As of 2021, FinTech accounted for the highest adoption rate (87%), making it the biggest destination for investment worldwide.

And the insights don’t stop here. The global financial technology market is expected to reach a market value of approximately $324 billion by 2026. As the popularity of the FinTech sector grows, the financial products grow altogether.

This made me feel If there ever was a time to build a FinTech app, that time is now. The financial market is ripe, and the problems to solve are plenty, and the resources and tools are readily available.

I figured we were going to have a long discussion on financial technology applications. So back up your belts because here are the milestones that lie ahead of you:

- FinTech industry overview

- Types of FinTech apps and software.

- Top 4 Features of 2021 blowing the FinTech Market

- Prearrangements of developing a FinTech application

- How to create an efficient and highly secure FinTech app

- FinTech App development Cost

- Developing FinTech App Challenges and Risks.

Financial (FinTech) Industry Overview:

What is FinTech?

FinTech is an umbrella term for any technology that runs on finances.

Yes! This means everything from banking to budgeting applications come under FinTech technologies.

Let’s start with the overview of the modern FinTech market to learn how we can possibly enter it and cash our FinTech idea.

What are essential aspects of our lives covered by the FinTech market?

Money is interwoven everywhere; therefore, classifying a specific sector that does not involve FinTech is almost next to impossible. Here are a few areas in our everyday lives that run with FinTech:

- Personal finance

- Insurance

- Trading solutions

- Money transferring

- Mortgage solutions

- Regtec software

- Cryptocurrency based solutions

- Wealth management

- Loans/Pending

- Payments

FinTech market (2021-2025)

According to the statistics of Business Research Company, the FinTech industry is estimated to reach $309.98 by the end of 2021. Growing at a CAGR rate of 24.8%, you have an over 60% chance of running a successful FinTech startup as every finance goes mobile.

And If you are worried about digital transactions, Inflexion featuring its mobile banking trends says, “ mobile transactions account for 88% of all the banking transactions”.

The biggest news for you is that more than 80% of the financial institutions such as insurance companies and banks are ready to invest in FinTech startups expecting a reasonable average return.

The FinTech market continues to expand with technologies like Cloud Computing, Blockchain, chatbots and artificial intelligence.

All of the above insights ask you to take your first step.

What is the first and most crucial step towards digitization?

Yes! Creating a mobile application. For a successful FinTech business, you need to build an effective and highly secure FinTech app that reflects your ideas, services and enhances the customer experience.

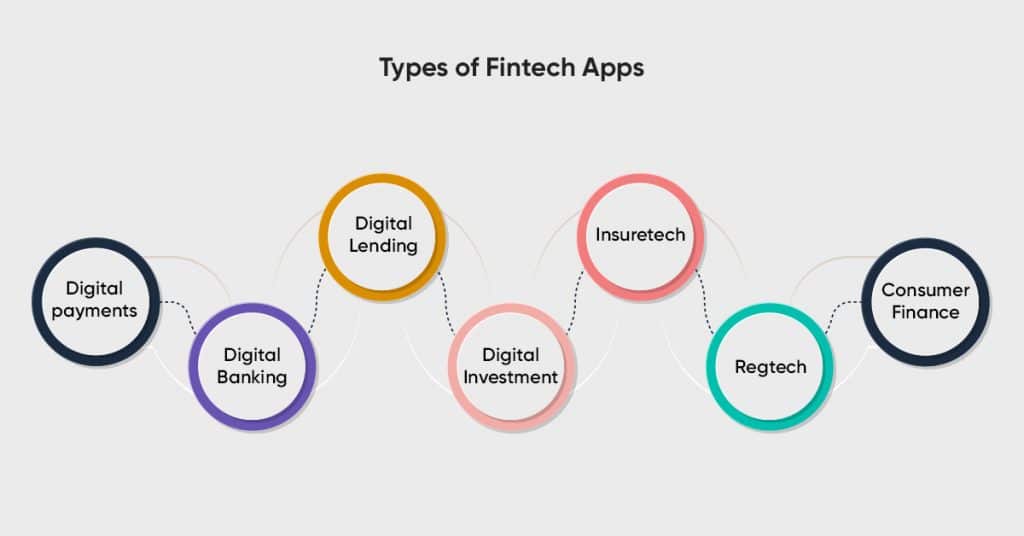

Types of FinTech apps and Software

The primary step towards building an effective FinTech app is to understand what technology is capable of and how your competitors utilise it.

Building software that corresponds with your business needs can be easy if you know the different development paths to take.

Let’s see what type of FinTech application suits your idea best:

Digital Payment apps:

The Digital payment category takes the most significant space in the FinTech sector. According to Statista, the digital transaction value is about to reach $8 billion in the coming two years. It is rising at a CAGR rate of 17% between 2020-24.

Many applications, from eCommerce to games, every application integrates payment processors into their systems.

Digital payments are also seemingly popular due to their convenience and speed. If you see cashless payment apps, payment processors and e-wallets, know that such applications belong to this category.

For a fast checkout, often business apps use processors and digital software. For instance:

- Apple Pay

- Stripe

- Braintree

- Venmo

- Payoneer

- PayPal etc.

With blockchain conquering the entire IT market, many applications have started offering cryptocurrency transactions. However, you can also develop stand-alone blockchain payment apps. An expert tip is if you want to enter the digital payment market, ensure that you offer something new to your target audience.

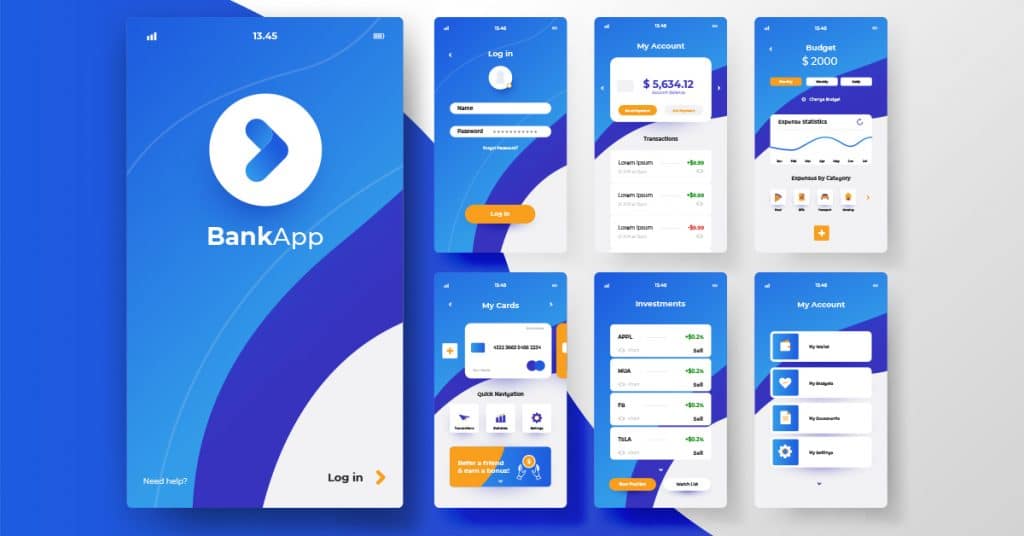

Mobile Banking Application:

Traditional banking applications have started offering personalized mobile apps, but we know only a few of them lived up to the customer’s expectations. Banking applications are ideal for transferring and managing funds without visiting the physical branch.

Moreover, mobile banking startups offer unlimited benefits: a range of advantages for customers allow banks to be more competitive with additional services. This again creates a new source of revenue.

What features do mobile banking applications offer?

- Secure authentication

- QR Payment codes

- Fast money transfer

- Customer service access

- Spending trackers and statistics

But these are general features. If you want your FinTech app to stand apart, you can start implementing features such as

- Managing savings

- Purchasing tickets

- Apple Pay integration and Google Pay

- Getting cashback

- Splitting bills etc.

Digital Lending Apps

There are various types of digital lending software. Some are introduced in the form of applications, while others come as AI-powered software products.

FinTech lending/borrowing platforms work in correspondence with the business models.

One such example is a Nigerian Digital lending app called Okash that notifies every single person in the payment list in case of a missed payment. More such FinTech apps are popular in the USA and China.

Another bizarre example is Zestfinance that uses Machine Learning to examine users with little credit history. The application was recently associated with Baidu and specialises in verifying credit scores for Baidu customers in China.

Investment Apps

Investment applications are one of the best guides to the stock market. They provide consumers with financial and analytical data and give a full range of tools and features for investment management.

So in most general cases, your investment app is your financial guide. Some apps even allow customized investing in paid versions.

One of the best startup investment applications is Robinhood. Robinhood gives you options trades, commission-free stock and an ETF. You can also select/choose cryptocurrencies.

Insurtech Apps

Insurtech software products are again the next-gen that range from simple websites to websites that give you complex solutions on the basis of the insurance you need. The websites and applications are able to access the users through AI.

Insurtech applications help customers optimize their interactions with insurance companies and banking institutions. This way, instead of calling the loan officer or agent, the user can simply place a claim through the app.

Take the reference of an application called “Attain” here. Attain is the partnership of Apple and an insurance organization. It designs fitness plans with customized goals and programs tracking daily using IoT devices. In Fact, the users are also rewarded with insurance discounts when active.

Regtech Apps:

Regtech helps you resolve the finance-related standard (Regulatory) issues. These kinds of FinTech applications run heavily on AI, big data and machine learning to security risks and compliance with law and regulations.

Enterprises and businesses generally use Regtech technologies to analyze their own policies and protocols associated with the law. Regtech is used for automation and analytics, helping businesses to avoid legal errors.

Platforms such as PassFort and 6 Clicks associate in this category that help organizations assess risk.

Consumer Finance Apps :

Consumer finance applications do not offer payment processing services on a general basis. Their primary goal is to help consumers manage their budget by planning efficiently and keeping track of expenses.

Consumer FinTech applications usually adhere to various banks and payment services like PayPal, Apple Pay and Google Pay. Feature-wise, such apps are relatively simple and offer a mindful UI to their users.

A few of the most popular applications are Goodbudget, Mint and Pocketguard.

These were some of the most user-friendly FinTech applications categories for you. While we are here, you would also want to explore various FinTech app features that your users want.

Top 4 Features of 2021 blowing the FinTech Market :

Machine Learning and AI:

With the facts of Autonomous Research, It is stated that financial institutions could reduce costs by 22% due to AI. The value of AI in FinTech is expected to rise to over $22.6 billion by the year 2026.

Now you can compare this value to $1.2 billion back in 2017.

Money is not the only factor you save. With Machine learning and AI, you achieve the below benefits:

- Financial assistance

- Risk assessment

- Cost reduction

- Security

- Automation

- Identity management

- Fraud detection etc.

By the time you read the above pros, many enterprises would have solved issues based on real-time data via AI.

Biometric Authentication:

Mobile technology has offered financial products with security and automation. Biometric authentication is one of the best ways to prevent identity theft. Besides security, the biometric approach is also convenient. This way, the users don’t have to type a password every time they log in to an app.

This approach follows two-factor authentication and is highly reliable to log in and approve transactions.

Chatbot Banking:

Chatbots are vital for every digital sector; retail and finance are some of the early adopters of this feature. Modern FinTech solutions use chatbots for customer support and transactions. Support chatbots are the most recent development in FinTech that help you with the bank offers and other details.

“THE ULTIMATE GOAL OF CHATBOTS IS TO REDUCE FRICTION BETWEEN BANKS AND CUSTOMERS”.

Most of the banks even allow customers to deliver transactions in the messaging applications themselves like Whatsapp and Messenger.

Blockchain:

You are not alone to think Blockchain is the fastest and most preferable sector in the financial technology industry. By 2024, blockchain claims to become a $20 billion industry facilitating maximum transactions.

Why Blockchain?

Blockchain gives you:

- Compatibility with current and future financial transactions

- The popularity of ICOs (Initial Coin Offerings)

- Faster and cheaper transactions

- Growth in the cryptocurrency market

Alas! We covered everything you need to know before actually developing a FinTech application. For more queries and application details, I would recommend taking technical guidance from a reliable mobile app development company.

Now that we are aware of the FinTech market positioning, application features and FinTech trends, we can hop on to the development process.

Pre Arrangements of Developing a FinTech Application :

There are five significant steps to follow before building an effective financial application.

1. Finding a Niche:

We have already discussed all kinds of major FinTech categories. Before you start with your development, choosing a specific niche that complies with your idea is extremely necessary. My advice would be to go for complex solutions since the simple solution financial market is oversaturated.

Think about the audience you want to serve before choosing a niche. There are still many regions and countries lacking FinTech solutions. You can find a go-to solution for their relevant set of financial and technical problems and enter fresh.

If you are worried about your options, here are some niches to work on:

- Cryptocurrency

- Insurance

- Regtech

- Money transfer

- Mortgage solutions

- Wealth management etc.

Also, think of a digital strategy before during time and efforts in the niche. The process is designed based on the target market and your app idea.

2. Complying with Legal Standards

Legal standards and protocols are unique to every region and country. Make sure that your application is applicable to the industry records. For example, there is no single entity to regulate FinTech bodies in the US, so a FinTech startup there would need to comply with various federal and state laws.

3. Clarifying the product’s vision and defining features

The first stage of FinTech mobile application development is establishing a vision and small goals to follow that vision. You must be able to determine the end goal of your app, what user issues would the app resolve, and what features would the app be known for.

If you have no prior experience in developing a FinTech product, expert guidance will help you fasten the process. Even better, take help from your development team.

Let’s see what your development team should look like.

4. Hiring a Development Team

A development team usually involves the following specialist :

- Front end developer

- Back end developer

- Business Analyst

- Designer

- Project manager

- Product manager

- Quality assurance officer

The number of specialists on your team usually depends on the scale of your project, your project deadlines and your requirements.

Most FinTech startups and companies prefer professional outsourcing teams since it saves enormous time and effort and are cost-effective.

5. Focusing on the user experience

The user experience is another most important factor after security. A good mobile or web applications development company can help you analyse the core audience, user roles and needs etc.

Now is the time to create some action. If you are ready for your custom mobile app development, let me walk you through the seven steps for creating an effective and highly secure FinTech application.

7 Steps To Create an Effective and Highly Secure FinTech Application:

Let’s say you want to create a rental management application.

Vision and Goals-

Your application will help users to place themselves in the queue, check credit scores of the potential tenants, manage the release and the end of the leasing contract. Your app would also allow users an easy contract renewal process.

To create such a secured app, you need the following features :

- Secure hosting with multiple failover redundancy

- User authentication with encryption

- A payment gateway

- Chabot to communicate with support

- Access to banking data and real-time transfers

- Credit score checking

You might think it would take you forever to work on the above features, but fortunately, there are APIs to help you.

Step 1: Authenticating and Managing Users

Tool- Firebase

This is basically the tool of choice for application building. Firebase offers you management, secure user authentication and crash reporting features. The tool integrates with a host of various Google services to provide a rich user experience.

Step 2: Secure Hosting

Tool- Cloud Firestone

Cloud Firestone is like the engine room encrypted with a cloud-hosted database solution. This product is well versed with all the Firebase products giving a seamless experience.

Step 3: Integrate Credit Score Checking

Tool – Experian/ Universal Credit Services

Experian comes with a consumer-facing API that reaches credit scores. These scores can also be shared with the third party online.

With the Credit score services tool, one can generate public records, FICO scores etc.

Step 4: Access Bank Account

Tool- Plaid

Plaid helps you to connect your app with other bank accounts. It’s very agile and can comprehend the financial data on a single platform.

Step 5: Setup Payment Gateway

Tool- Stripe

Stripe is a global payments processor that merges several payment services into one solution freeing you from credit details.

Step 6: Implement Chat

Tools- Chatbot

Chatbot’s API helps automate customer service. You can use Machine learning, AI to serve your consumers. You can also use open source libraries like Python Scikit for preprocessing tasks.

Step 7: Add Bonus Plugins

If you think data visualization is an essential feature for your app, D3 can be your go-to framework. D3.js is a Javascript library to manipulate data and create visualizations using CSS, SVG and HTML.

Once you load your FinTech application with such features, go live in the market by releasing its MVP. Take feedback from the actual users to analyze the competition. After relevant suggestions, you can refine and support your app accordingly.

Now, the only question you’d be left with is the cost of developing FinTech apps.

How much does it cost to develop a FinTech app?

The cost of FinTech application development depends on several factors:

- Design complexity

- Project size

- No. of team members

- Features infused etc.

You can anyway divide the development cost into three major categories:

- Cost by type of an app

- Expense by type of a team

- Cost by location

For customized development estimates, you can always seek guidance from a mobile app development company.

All good that comes from FinTech application development has been kept in front of you. But every business comes with its own set of risks and challenges.

Let’s end our FinTech development guide with some potential challenges that can come along with your development process.

FinTech app development risks and challenges:

Security is the biggest challenge for any FinTech application. No matter how convenient your application is, it can only bring revenue if the user feels safe with its data.

A few threats to today’s FinTech market are:

- Malware attacks

- Identity theft

- Security vulnerabilities

- Data breaches

To ensure your FinTech application is secure, you need to keep maintaining and updating it with regular security audits.

You Are Not Alone!

Are you looking to develop A FinTech application this time?

Taking mobile application development services is one of the most convenient ways. You will have a team to partner with. If you have an amazing FinTech app idea, do not hesitate to share it with us. Let’s create your next masterpiece together.